Learning Objectives

Learning Objectives

By the end of this section, you will be able to do the following:- Explain the U.S. federal budget in terms of annual debt and accumulated debt

- Understand how economic growth or decline can influence a budget surplus or budget deficit

Having discussed the revenue—taxes—and expense—spending—sides of the budget, we now turn to the annual budget deficit or surplus, which is the difference between the tax revenue collected and spending over a fiscal year, which starts October 1 and ends September 30 of the next year.

Figure 16.7 shows the pattern of annual federal budget deficits and surpluses, back to 1930, as a share of GDP. When the line is above the horizontal axis, the budget is in surplus; when the line is below the horizontal axis, a budget deficit has occurred. Clearly, the biggest deficits as a share of GDP during this time were incurred to finance World War II. Deficits were also large during the 1930s, the 1980s, the early 1990s, and most recently during the Great Recession of 2008–2009.

Debt/GDP Ratio

Debt/GDP Ratio

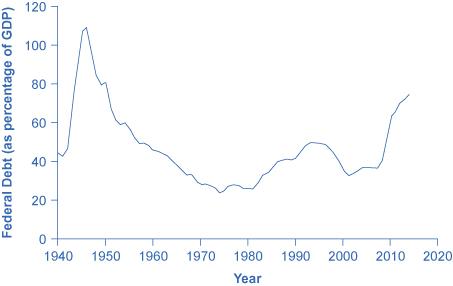

Another useful way to view the budget deficit is through the prism of accumulated debt rather than annual deficits. The national debt refers to the total amount that the government has borrowed over time; in contrast, the budget deficit refers to how much has been borrowed in one particular year. Figure 16.8 shows the ratio of debt/GDP since 1940. Until the 1970s, the debt/GDP ratio revealed a fairly clear pattern of federal borrowing. The government ran up large deficits and raised the debt/GDP ratio in World War II, but from the 1950s to the 1970s, the government ran either surpluses or relatively small deficits, and so the debt/GDP ratio drifted down. Large deficits in the 1980s and early 1990s caused the ratio to rise sharply. When budget surpluses arrived from 1998 to 2001, the debt/GDP ratio declined substantially. The budget deficits starting in 2002 then tugged the debt/GDP ratio higher—with a big jump when the recession took hold in 2008–2009.

The next Clear it Up feature discusses how the government handles the national debt.

Clear It Up

What is the national debt?

One year’s federal budget deficit causes the federal government to sell Treasury bonds to make up the difference between spending programs and tax revenues. The dollar value of all the outstanding Treasury bonds on which the federal government owes money is equal to the national debt.

The Path from Deficits to Surpluses to Deficits

The Path from Deficits to Surpluses to Deficits

Why did the budget deficits suddenly turn to surpluses from 1998 to 2001? And why did the surpluses return to deficits in 2002? Why did the deficit become so large after 2007? Figure 16.9 suggests some answers. The graph combines the earlier information on total federal spending and taxes in a single graph, but focuses on the federal budget since 1990.

Government spending as a share of GDP declined steadily through the 1990s. The biggest single reason was that defense spending declined from 5.2 percent of GDP in 1990 to 3.0 percent in 2000, but interest payments by the federal government also fell by about 1.0 percent of GDP. However, federal tax collections increased substantially in the late 1990s, jumping from 18.1 percent of GDP in 1994 to 20.8 percent in 2000. Powerful economic growth in the late 1990s fueled the boom in taxes. Personal income taxes rise as income goes up; payroll taxes rise as jobs and payrolls go up; corporate income taxes rise as profits go up. At the same time, government spending on transfer payments such as unemployment benefits, foods stamps, and welfare declined with more people working.

This sharp increase in tax revenues and decrease in expenditures on transfer payments were largely unexpected, even by experienced budget analysts, and so budget surpluses came as a surprise. But in the early 2000s, many of these factors started running in reverse. Tax revenues sagged, due largely to the recession that started in March 2001, which reduced revenues. A series of tax cuts was enacted by Congress and signed into law by President George W. Bush, starting in 2001. In addition, government spending swelled due to increases in defense, healthcare, education, Social Security, and support programs for those who were hurt by the recession and the slow growth that followed. Deficits returned. When the severe recession hit in late 2007, spending climbed and tax collections fell to historically unusual levels, resulting in enormous deficits.

Longer-term forecasts of the U.S. budget, a decade or more into the future, predict enormous deficits. The higher deficits run during the Great Recession of 2008–2009 have repercussions, and the demographics will be challenging. The primary reason is the baby boom—the exceptionally high birthrates that began in 1946, right after World War II, and lasted for about two decades. Starting in 2010, the front edge of the baby boom generation began to reach age 65, and in the next two decades, the proportion of Americans over the age of 65 will increase substantially. The current level of payroll taxes that support Social Security and Medicare will fall well short of the projected expenses of these programs, as the following Clear It Up feature shows; thus, the forecast is for large budget deficits. A decision to collect more revenue to support these programs or to decrease benefit levels would alter this long-term forecast.

Clear It Up

What is the long-term budget outlook for Social Security and Medicare?

In 1946, just one American in 13 was over age 65. By 2000, it was one in eight. By 2030, one American in five will be over age 65. Two enormous U.S. federal programs focus on the elderly—Social Security and Medicare. The growing numbers of elderly Americans will increase spending on these programs, as well as on Medicaid. The current payroll tax levied on workers, which supports all of Social Security and the hospitalization insurance part of Medicare, will not be enough to cover the expected costs. So, what are the options?

Long-term projections from the CBO in 2009 are that Medicare and Social Security spending combined will rise from 8.3 percent of GDP in 2009 to about 13 percent by 2035 and to about 20 percent in 2080. If this rise in spending occurs, without any corresponding rise in tax collections, then some mix of changes must occur: (1) Taxes will need to be increased dramatically; (2) other spending will need to be cut dramatically; (3) the retirement age and/or age receiving Medicare benefits will need to increase; or (4) the federal government will need to run extremely large budget deficits.

Some proposals suggest removing the cap on wages subject to the payroll tax, so that those with very high incomes would have to pay the tax on the entire amount of their wages. Other proposals suggest moving Social Security and Medicare from systems in which workers pay for retirees toward programs that set up accounts where workers save funds over their lifetimes and then draw out after retirement to pay for healthcare.

The United States is not alone in this problem. Indeed, providing the promised level of retirement and health benefits to a growing proportion of elderly with a falling proportion of workers is an even-more severe problem in many European nations and in Japan. How to pay promised levels of benefits to the elderly will be a difficult public policy decision.

In the next module, we shift to the use of fiscal policy to counteract business cycle fluctuations. In addition, we will explore proposals requiring a balanced budget—that is, for government spending and taxes to be equal each year. The Impacts of Government Borrowing will also cover how fiscal policy and government borrowing will affect national saving—and thus affect economic growth and trade imbalances.