Learning Objectives

Learning Objectives

By the end of this section, you will be able to do the following:- Analyze historical patterns of immigration

- Explain the economic effects of immigration

- Evaluate notable proposals for immigration reform

Immigration is a complicated and challenging issue, often leading to heated debate.

Historical Patterns of Immigration

Historical Patterns of Immigration

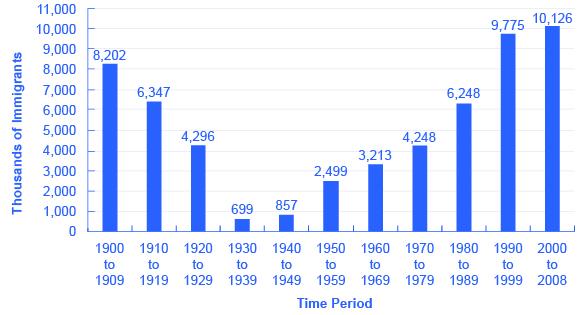

Supporters and opponents of immigration look at the same data and see different patterns. Those who express concern about immigration levels to the United States point to graphs such as Figure 15.7, which shows the total inflows of immigrants, decade by decade, through the 20th century. Clearly, the level of immigration has been high and rising in recent years, reaching and exceeding the towering levels of the early 20th century. However, those who are less worried about immigration point out that the high immigration levels of the early 20th century happened when the total population was much lower. Because the U.S. population roughly tripled during the 20th century, the seemingly high levels in immigration in the 1990s and 2000s are relatively smaller when they are divided by the population.

Where have the immigrants come from? Immigrants from Europe were more than 90 percent of the total in the first decade of the 20th century, but less than 20 percent of the total by the end of the century. By the 2000s, about half of U.S. immigration came from the rest of the Americas, especially Mexico, and about a quarter came from various countries in Asia.

Economic Effects of Immigration

Economic Effects of Immigration

In this section, we will analyze how foreign born workers can benefit an economy, how immigrant workers impact wage rates, and how immigration influences federal and local government spending.

To understand the economic consequences of immigration, consider the following scenario. Imagine that the immigrants entering the United States matched the existing U.S. population in age range, education, skill levels, family size, occupations, and so on. How would immigration of this type affect the rest of the U.S. economy? Immigrants themselves would be much better off, because their standard of living would be higher in the United States. Immigrants would contribute to both increased production and increased consumption. Given enough time for adjustment, the range of jobs performed, income earned, taxes paid, and public services needed would not be affected much by this kind of immigration. It would be as if the population simply increased a little.

Now, consider the reality of recent immigration to the United States. Immigrants are not identical to the rest of the U.S. population. About one third of immigrants over the age of 25 lack a high school diploma. As a result, many of the recent immigrants end up in jobs such as restaurant and hotel work, lawn care, and janitorial work. This kind of immigration represents a shift to the right in the supply of unskilled labor for a number of jobs, which will lead to lower wages for these jobs. The middle- and upper-income households that purchase the services of these unskilled workers will benefit from these lower wages. However, low-skilled U.S. workers who must compete with low-skilled immigrants for jobs will tend to suffer from immigration.

The difficult policy questions about immigration are not so much about the overall gains to the rest of the economy, which seem to be real but small in the context of the U.S. economy, as they are about the disruptive effects of immigration in specific labor markets. One disruptive effect, as just noted, is that immigration weighted toward low-skill workers tends to reduce wages for domestic low-skill workers. While research is ongoing, and no definitive conclusions have been reached, one study by Michael S. Clune found that for each 10 percent rise in the number of employed immigrants with no more than a high school diploma in the labor market, high school students reduced their annual number of hours worked by 3 percent. The effects on wages of low-skill workers are not large—perhaps in the range of about a 1 percent decline. These effects are likely kept low, in part, because of the legal floor of federal and state minimum wage laws. In addition, immigrants are also thought to contribute to an increased demand for local goods and services, which can stimulate the local low skilled labor market. It is also possible that employers, in the face of abundantly low-skill workers, may choose production processes that are more labor intensive than otherwise would have been. These various factors would explain the small negative wage effect observed among the native low-skill workers as a result of immigration.

Another potential disruptive effect is the impact on the budgets of state and local government. Many of the costs imposed by immigrants are costs that arise in state-run programs, such as the cost of public schooling and welfare benefits. However, many of the taxes that immigrants pay are federal taxes, such as income taxes and Social Security taxes. Many immigrants do not own property—such as homes and cars—so they do not pay property taxes, which are one of the main sources of state and local tax revenues. They do pay sales taxes, which are state and local, and the landlords of the property they rent pay property taxes. According to the nonprofit Rand Corporation (2012), the effects of immigration on taxes are generally positive at the federal level, but they are negative at the state and local levels in places where there are many low-skilled immigrants.

As noted above, despite the studies cited in this section, other studies have reached different conclusions, thus economic research continues into this important issue.

Link It Up

Visit this website to obtain more context regarding immigration.

Proposals for Immigration Reform

Proposals for Immigration Reform

The Congressional Jordan Commission of the 1990s proposed reducing overall levels of immigration and refocusing U.S. immigration policy to give priority to immigrants with a higher level of skills. In the labor market, focusing on high-skilled immigrants would help prevent any negative effects on the wages of low-skilled workers. For government budgets, higher-skilled workers find jobs more quickly, earn higher wages, and pay more in taxes. Several other immigration-friendly countries, notably Canada and Australia, have immigration systems where those with high levels of education or job skills have a much better chance of obtaining permission to immigrate. For the United States, high-tech companies regularly ask for a more lenient immigration policy to admit a greater quantity of highly skilled workers. In addition, a current immigration issue deals with the so-called DREAM Act legislation (not yet passed by Congress (as of print date), which would offer a path to citizenship for illegal immigrants brought to the United States before the age of 16. However, some state legislatures, such as California, have passed their own Dream acts.

If the United States decided to reduce immigration substantially, the economic losses would likely be small relative to the overall economy. If the United States decided to increase immigration substantially, the U.S. economy certainly is large enough to afford some additional assistance to low-wage workers or to local governments that might be adversely affected by immigration. Whether immigration levels are increased, decreased, or left the same, the quality of the debate over immigration policy would be improved by an explicit recognition of who receives economic benefits from immigration and who bears its costs.

Bring It Home

Collective Bargaining in Wisconsin

Should we end collective bargaining rights for government employees? In an effort to reduce the budget deficit, a contentious Wisconsin law prohibited most public employees from collectively bargaining on anything except wages. Legislators in Wisconsin argued that public safety is so important that public safety workers should be exempted from this. They could not risk firefighters and police going on strike. All firms and employees know that pensions and benefits are expensive, and there was a $3.6 billion budget deficit in Wisconsin that Governor Walker and legislators wanted to decrease. A lingering question is: Should the unions have been more willing to shoulder a greater burden of the cost of those benefits? This question suggests that it is the cost, not necessarily the role of the union itself, that is the problem. After all, unions were founded to reduce the disadvantage that single employees face when bargaining with employers. Because so many government employees are union members, collective bargaining is even more important for them.

Ultimately, the benefit of unions is in the impact they have on economic productivity and output. The more productive the union workers become as a result of collective bargaining, the better off the economy will be.

The long-term repercussions of the Wisconsin law have yet to be realized. As a result of this bill, wage increases higher than the rate of inflation for Wisconsin public sector employees must be voted upon. Imagine if you are working for the Wisconsin government and are able to find a higher-paying job in the private sector. What would you do? If you decide to leave because your options are better elsewhere, then the government must replace you. How will the government find a worker to replace you? For some sectors of the government, reduced numbers of workers may mean greater efficiency. For other sectors, though, reduced numbers of government workers may mean reduced services.

Disclaimer

This section may include links to websites that contain links to articles on unrelated topics. See the preface for more information.